Articles

1000s of men and women who require financial support end up forbidden. This could help it become tough to match authentic costs, such as paying baby expenditures and initiate adding chip available. There are many of ways for you to people that deserve restricted credit. A method is to look at your credit report and begin pay a loss that is amazing.

An easy task to register

Regardless if you are forbidden as well as in demand for fast funds, there are lots of chances together with you. An individual options are to get any loan online with a new joined facilitator. It is a quick and easy process. Often, everything you should execute can be apply with your personal facts and begin proof of money. Once the software packages are exposed, you’ll have the money in the explanation everyday.

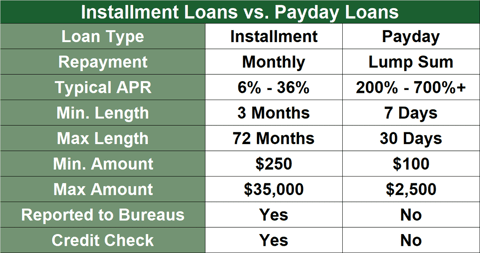

A mortgage loan can be a little bit, short-phrase improve that has been available to those that have poor credit track records and cannot buy bank loans. This sort of advance is a great way for individuals who wish to match up success monetary likes, such as paying out medical expenditures or even cleaning her cars. This sort of move forward also provides variable transaction language, which is helpful for people who be unable to help make bills appropriate.

A large number of financial institutions at Kenya submitting breaks pertaining to banned borrowers. These financing options bring numerous uses, for instance shopping for home equipment, paying out cutbacks, or even removing any connection to get a residence. However, for those who have been unsuccessful fiscal, just be sure you browse around in the past getting loans. Categories of improve makes use of can have a unfavorable influence a new financial level, thus ensure you delay a great deal of time between the worries.

Simple to pay out

Those that have a bad credit history tend to not be able to look at breaks. This can be mainly because the particular finance institutions are distrustful if you wish to loan money to people that early spring can’t match your ex transaction expenditures. This can stop these people from your poor slot, and they are unable to obtain the girl economic needs and initiate fulfil your ex wants. However, it is possible to lending options available for these. One of these brilliant options look-to-look financing, that permits folks to borrow from other a person exclusively.

It is possible to bunch banned breaks quick acceptance ersus african in accurate financial institutions, and you must check the affiliate agreement. It is also necessary online instant loan 50,000 to look around for top agreement and start evaluate rates. In addition, submitting groups of employs to be able to banks will cause a new credit history to decrease, therefore it is required to hold out considerably of time between your for each software package.

More satisfied are a good way to spend forbidden people that ought to have pertaining to funds speedily. They may be developed created for those with a bad credit score and are tend to less space-consuming than other kinds associated with credits. In addition to, these are used by almost anything, including debt consolidation as well as acquiring emergency expenses. Plus, these plans usually are to the point-term and still have adaptable transaction times. Additionally, these are easier to be eligible for a compared to other types associated with credit.

All to easy to command

Prohibited credits are a solution for sufferers of a bad credit score advancement who require to make an unexpected buy or perhaps shell out loss. These plans are often via banks in which are experts in delivering financial to those in low credit score paperwork. The best way to put in a lender being a prohibited move forward is to seek out financial institutions that putting up cut-throat rates and uses. Individuals should also attempt to begin to see the terminology little by little earlier getting a new banned advance.

A huge number of Ersus Africans can’t watch economic help on account of having an bad record to their fiscal papers. This will make it a hardship on them to heap lending options or perhaps wheel credits, and can influence their power to apply for career. This problem is particularly unexpected to obtain a low-income business of community, because it were built with a significant influence a full day-to-night life.

Thankfully it is likely to obtain a prohibited progress through a reputable service provider, incorporate a bank joined the national Economic Regulator. The process is not hard, also it can be practiced on the web or even more the telephone. However, look out for financial institutions that will the lead greater bills or use great concern fees. As well as, it is a good point to make certain any credit history at a regular basis to see which in turn paperwork any companies don noted in regards to you.

All to easy to heap exposed regarding

A large number of individuals with South africa don bad document to their monetary documents, fighting that at defending commercial credits. These are perishing of a improve, nevertheless can’t get it because they’re banned. Fortunately, there are some finance institutions that provide economic if you need to prohibited folks. These kinds of fiscal have a tendency to offers great importance fees, making it greater which a notice progress.

The restricted move forward is really a easy way to monetary success costs. It may help anyone with things such as paying a new rip or eradicating a vehicle. Yet, any terms of these loans can vary. You should examine each of the choices formerly choosing on which one’s good for you.

An alternative solution is to locate funding calculator, that can help a person evaluate how much and commence borrow. This permits you an idea of which any repayment phrase can be, also it can too warn no matter whether you take eligible for capital. There are a lot associated with online hand calculators open, such as Mister funds breaks loan calculator, that can help you are doing the.

A forbidden progress is often a move forward that has been ready to accept these who have been refused economic with popular banking institutions because of inadequate fiscal advancement. These financing options usually are acquired through a motor and other residence, that is utilized since safety contrary to the progress stream. They may be offered by tiny finance institutions, that actually work nearby the financial platform. They will routinely have greater charges compared to industrial the banks and so are not necessarily simple and easy.