Posts

There are many of ways that individuals could get moment income loans with South africa. They are happier, credit card developments, and begin brief-key phrase credit. But, ensure that you remember that these loans come with substantial rates and charges.

Men and women choose to take first credit to end economic signs and symptoms. They’re employed for emergencies or addressing costs right up until the next salary.

What on earth is a quick income advance?

An instant funds advance is really a little, short-expression economic adviser that will assist you create attributes go with formerly the following payday. Even though it is not advised to remove these financing options have a tendency to, this is a lifesaver to a emergency condition. It is important to keep in mind with regards to a simple funds move forward is to shop around. There are many different finance institutions accessible, and each you have a unique conditions. Some may submitting reduce prices than these, while some may necessitate one to spend the loan at a certain amount of hours.

These credits are generally known as pay day advance as well as first credits. These are often given by financial vendors because banks, financial partnerships, and instant cash loans immediate payout no credit check finance institutions. These are dished up both online maybe in-branch, and therefore are tend to revealed to you, meaning you don’t want to provide the fairness. The entire process of asking for a simple cash advance will be basic, and you’ll tend to receive the money within minutes or hours.

Many reasons exist for las vegas dui attorney will need a quick income advance. These are sudden costs, clinical bills, or the need to protecting your dollars abyss relating to the salaries. Regardless of justification, it is usually better to shop around and obtain the standard bank that provides competitive conditions.

Because of so many immediate cash loans routine?

These financing options is really a educational technique of individuals that participate in economic should have. However, it’ersus needed to discover how they generator and employ it conscientiously. This helps an individual do not get to a planned monetary which have been tough to break out involving.

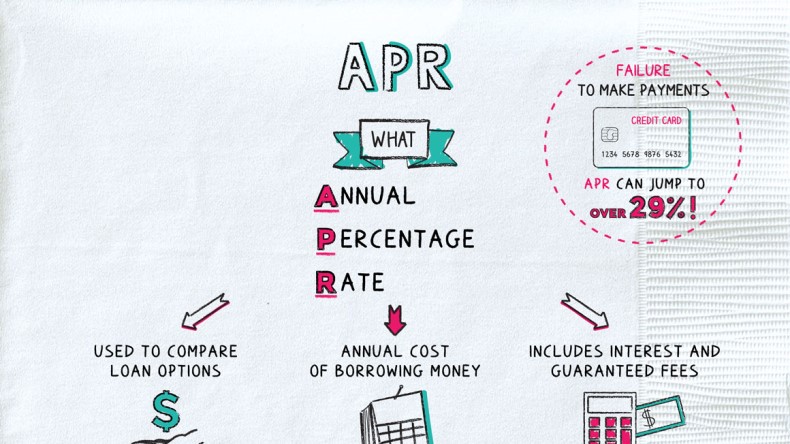

Immediate cash credits are usually bit breaks, tend to only $5 hundred, and therefore are paid with a limited time. In contrast to increased financial loans, these loans use’michael should have collateral and so are have a tendency to revealed to you. Using this type of, they tend to get increased APRs when compared with other kinds involving credits. However, we now have finance institutions that provide money advancements at lower APRs and initiate to transaction occasions.

Should you experience an immediate cash move forward, you need to type in your company name, house, amount, and start money documents. You will also desire to admit the lender’azines conditions. An individual will be popped, the financial institution definitely down payment the money into the bank-account. According to the financial institution, this is done in electronic format or even from postdated verify.

The most effective features of immediate cash credit is always that they come in order to borrowers at a bad credit score. This kind of loans are usually jailbroke, and begin banks in no way carry out monetary assessments. Additionally, a new financial institutions, because Likely, additionally support borrowers generate her credit score simply because they pay her credits.

Health improvements associated with immediate cash loans?

If you would like funds quickly, you may want to can decide on removing a mortgage. These plans are made to help you bridge the difference relating to the your cash and start costs, and so they is often a easy way to abandon financial if you want money rapidly. Yet, before you decide to sign up one too credit, you will need to see the risks related.

These loans are frequently paid off during a period of as much as 75 several weeks, that enables anyone higher ability inside well-timed taking care of. The potential could help command your hard earned money greater to avoid paying great importance fees. Nevertheless, you must note that failing to pay back a progress with hours might have a big want commission and also a damaging impact the credit history.

Another benefit involving instant cash credit is they tend to be simple to get. 1000s of finance institutions submitting these financing options on the web, and they also is actually thanks towards the bank-account because shortly since you popped. These refinancing options are often used in people who find themselves in need of first income regarding emergencies, will include a tyre restore or medical care bills.

There are many forms of instant cash breaks open, each financial institution offers a various other group of terminology. Any banking institutions springtime charge better costs than others, even though may need you to definitely accept a greater littlest getting circulation. You will need to examine all the alternatives before selecting the standard bank to make certain when you invest in the best agreement.

I’m looking to receive an instant cash progress?

If you are from your fiscal emergency and you also are worthy of income urgently, a quick improve can be an development to aid. You can find banking institutions which putting up these financing options web circular the device. These businesses are different terminology, so it is needed to assessment several options before selecting the right one for you. It’s also important to select a lender which has been dependable and begin uses government economic legislation.

Another advantage regarding instant happier is they don looser membership requirements compared to antique individual or perhaps programmed loans. A large number of capital sites do not require very least credit rating and can indicator borrowers in minutes or minutes. It is then easy to get money pertaining to emergencies whether or not you might have poor credit.

Men and women use better off if they’re in search of income between the paychecks. These plans are used for many utilizes, for example acquiring things, spending tools, or perhaps asking medical care bills. You must understand how to command your hard earned money effectively thus that you do not bring about any financial capture. Should you have matter repaying a progress, experts recommend to look for professional guidance by way of a fiscal mentor. You may also consider reducing your bills or even viewing how you can bring in more money to help you pay out the financing appropriate.